Global lessons for the UK in carbon taxes

Carbon pricing is particularly topical in the UK right now: the country recently committed to a statutory ‘net-zero’ emissions target by 2050 – a meaningful price on carbon is essential for this target to have policy credibility – and, as part of the Brexit process, the UK has to revisit its main current carbon pricing mechanism, the EU Emissions Trading System.

After analysing global trends in carbon taxation and differences in tax design around the world, this policy brief draws out lessons for the design of a possible new carbon tax for the UK. Some of the lessons come from a detailed case study of carbon tax revenue recycling in British Columbia, Canada.

Headline issues

- Putting a higher price on carbon is essential for the UK to cost-effectively meet its ‘net-zero’ emissions target and make polluters pay.

- A carbon tax would price carbon effectively, either alongside or instead of carbon trading under the EU Emissions Trading System.

- A carbon tax should be fair, rise gradually over time and have transparent, well-communicated rules about the use of revenue.

Summary points

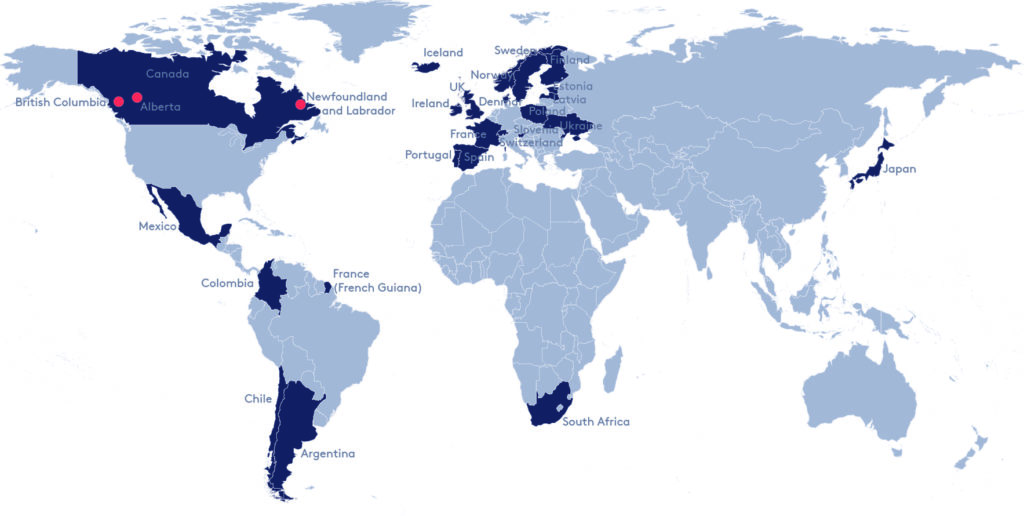

The global experience with carbon taxes is growing, although less than 6 per cent of global greenhouse gas emissions are taxed currently. Some countries have taxed carbon for more than 25 years, but most schemes are more recent. Where emissions are taxed, this has helped to lower emissions, even though tax rates are often low or subject to significant exemptions.

Regional, national and sub-national carbon taxes around the world, July 2019. Source: Recreated from World Bank (2019)

Taxing carbon can be politically controversial but it is possible to design a carbon tax that is both effective and publicly acceptable. To be effective in the UK, the tax level needs to be consistent with the country’s new ‘net-zero’ emissions target. In most sectors, this means a starting point of around £40 per tonne of carbon dioxide by 2020. The tax should take into account complementary carbon policies (e.g. innovation support) and existing fiscal measures (e.g. taxes on transport fuels). To be credible, there must be clear rules, not subject to political pressure, on how the tax trajectory is adjusted over time.

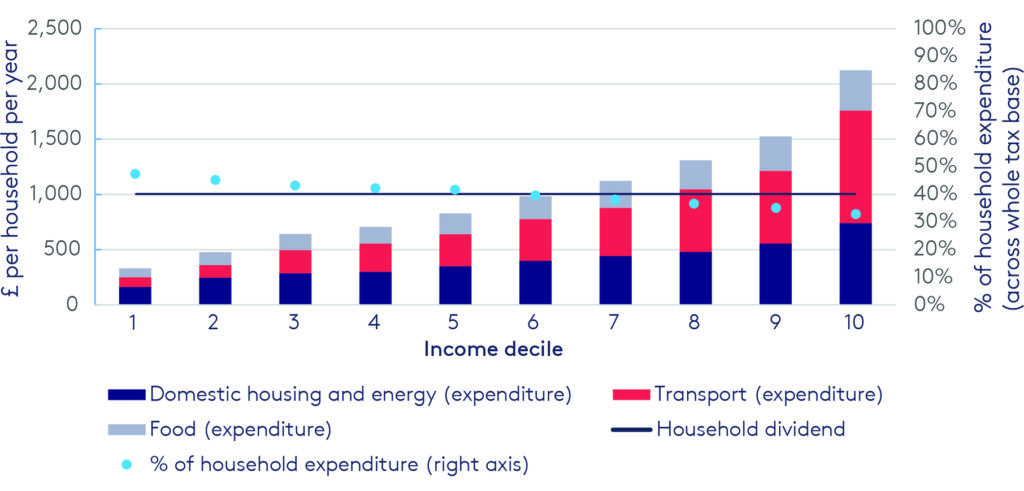

Illustrative tax payments and revenues by income decile, UK. The graph illustrates the progressive nature of uniform lump sum dividends for a hypothetical UK carbon tax of £40 per tCO2. The tax affects 47 per cent of expenditures in the poorest 10 per cent of households (income decile 1), but only 33 per cent of household expenditures by the richest 10 per cent (income decile 10). However, the tax raises enough revenue to give each household an equal ‘dividend’ of £1,000 per year, leaving the lowest five income deciles (i.e. half of all households) better off.

To be publicly acceptable, the tax rate should start low and rise over time. That way, people can observe the environmental effectiveness of the tax and the manner in which revenues are redistributed. Tax revenues can be used to further enhance public acceptability, for example by cushioning socioeconomic side-effects via carbon dividends (direct payments to affected households), lowering other taxes or investing in additional ways to reduce emissions. It is essential for public acceptability that the use of proceeds is carefully explained, alongside information on the environmental, social and economic impacts of the tax.